June 25

2024

June 25

2024

VOX

by

Alex Abad-Santos

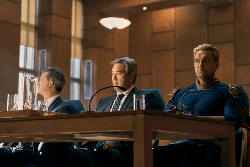

The fourth season of The Boys is being review-bombed by some viewers who claim it has suddenly become “woke” or anti–Donald Trump, despite the series having always been an explicit satire of Trump-like authoritarianism, corporate power, and fascist politics. Showrunner Eric Kripke has long described Homelander as a Trump analogue, and season four makes the parallels even more direct by centering a criminal trial and an incited, January 6-like insurrection. The backlash has driven the season’s audience score sharply below its critical reception, reflecting both coordinated rating attacks and a subset of fans realizing belatedly that they are the target of the show’s critique. The episode highlights a recurring pop-culture pattern in which audiences can miss or deny the political intent of s...